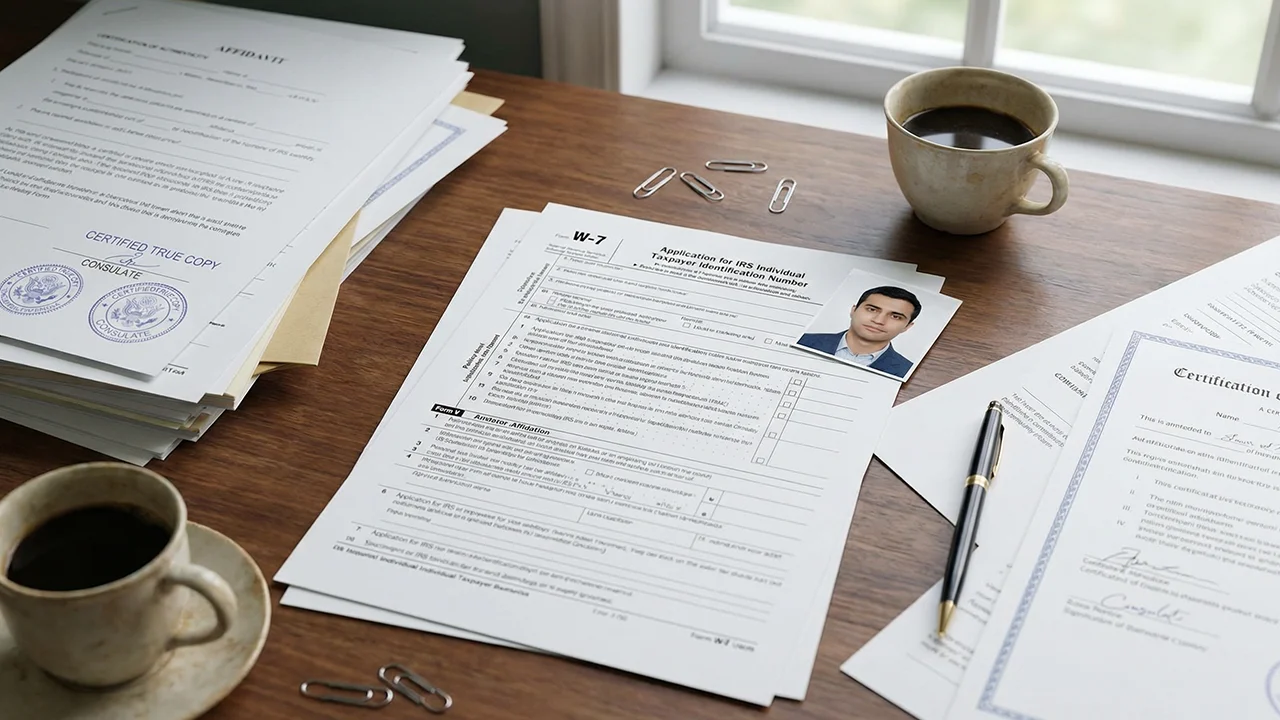

If you are a foreign national who needs to file US taxes but is not eligible for a Social Security Number (SSN), you need an Individual Taxpayer Identification Number (ITIN).

However, the standard application process has a major flaw: the IRS requires you to mail your original passport to them.

The Risk of Mailing Documents

Mailing your passport involves significant risk. It can get lost in the mail, or the IRS processing center might hold onto it for weeks or even months. For many, being without a passport for that long is simply not an option.

The Solution: A Certified Acceptance Agent (CAA)

A Certified Acceptance Agent (CAA) is a person or entity authorized by the IRS to assist alien individuals in obtaining ITINs.

Why Use a CAA?

- Keep Your Passport: CAAs are authorized to verify your original documents (like your passport) in person. They submit a copy to the IRS with a certificate of accuracy. You walk out of the appointment with your passport in hand.

- Reduce Rejections: ITIN applications (Form W-7) are frequently rejected due to minor errors. A CAA ensures the form is filled out correctly and the supporting documentation is perfect.

- Faster Processing: While IRS timelines vary, applications submitted by CAAs are often processed more smoothly because the identification has already been vetted.

Conclusion

Don’t risk your travel documents. Using a CAA service is the safest, most efficient way to secure your ITIN and ensure you remain compliant with US tax laws.